Request To Waive Penalty / Form NC-5500 Download Printable PDF or Fill Online Request ... / Alternatives to requesting waver of interest and penalties.

Request To Waive Penalty / Form NC-5500 Download Printable PDF or Fill Online Request ... / Alternatives to requesting waver of interest and penalties.. Write a letter to the irs requesting a penalty waiver. Fill penalty waiver request letter sample, download blank or editable online. Penalty abatement does not remove the penalty only the penalty dollars at the time of request. After six months, you'll also be charged 5% of the tax owed or £300 (whichever is greater), and this happens again after 12 months. Request for transcript of tax return.

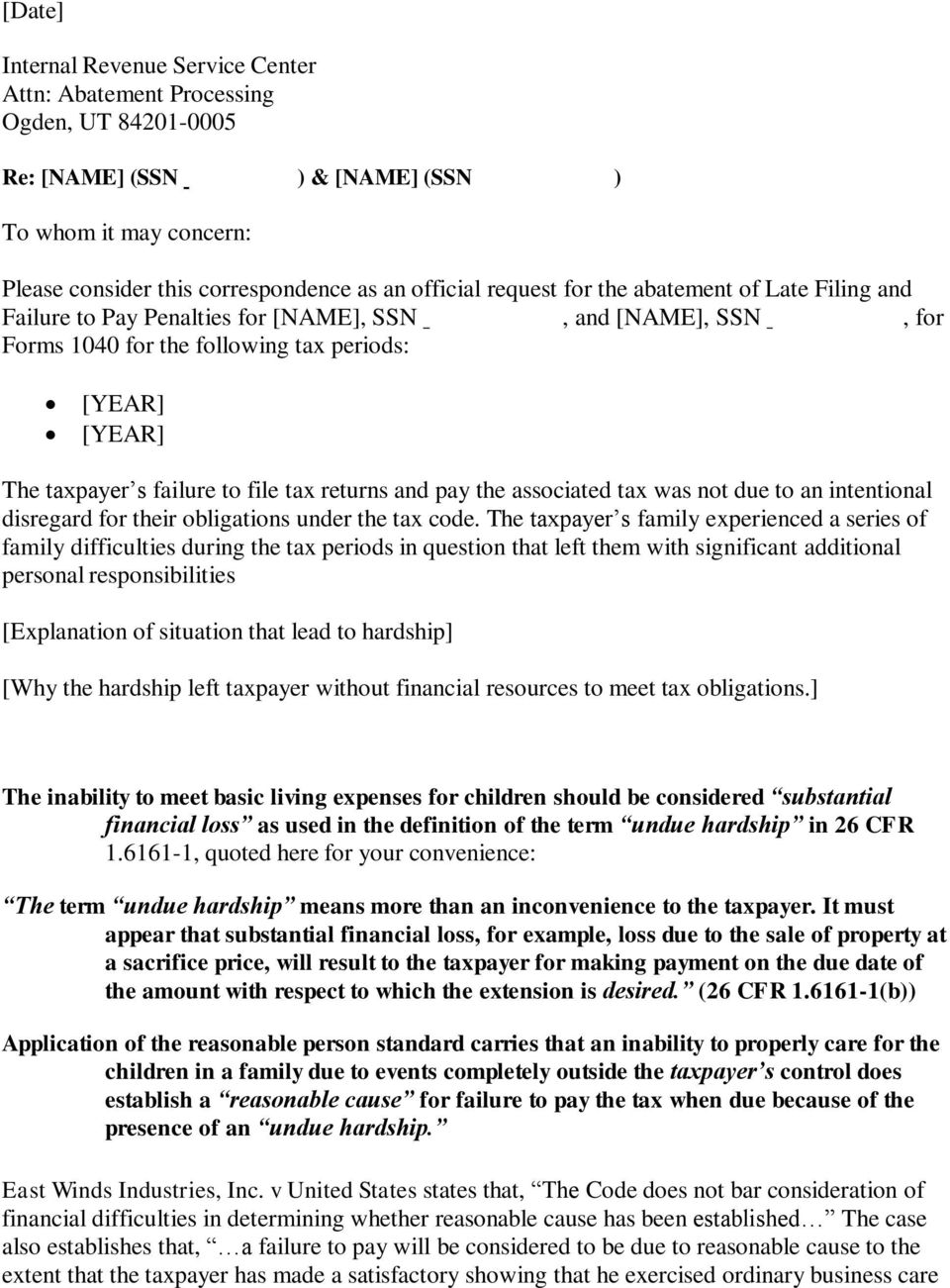

How to waive penalty for missed filing date and secretary of state charging penalty of $250 for corporation. I am writing to request that you waive the penalty of {amount} on account number {number}. I recognize that a mistake was made by me and would rectify the problem. List the type(s) of tax for which this request applies along with the amount of penalty and the tax period(s) covered. How to write a letter to waive fees sample letter of waiving.

To others that want the sample letter, i am a little behind in creating the form so that people can get the letter automatically.

To request a waiver, form 2210, also known as the underpayment of estimated tax by individuals, estates, and trusts form, must be filed. When their chances of getting the extra penalties and interest waived is slim, people often wonder what they should do if they cannot pay the total amount in one payment. Further penalties of £10 a day are applied after three months, up to a maximum of £900. The cra waived interest on tax debts related to individual, corporate, and trust income tax returns from april 1, 2020, to september 30, 2020 and from april 1, 2020, to june 30, 2020, for goods and taxpayers do not need to make a request for the cancellation of penalties and interest for this period. For instance, you may be given a citation. Penalties may be waived in delinquency or deficiency cases if the taxpayer has a reasonable cause taxpayers who are unable to access the information electronically should submit the petition for waiver of penalty via email to penalty.waivers@tn.gov to request to waive a penalty. Перевод контекст waive the penalty c английский на русский от reverso context: You may also send a letter to us at the address below explaining the situation and the reason you believe you should not be. How to waive penalty for missed filing date and secretary of state charging penalty of $250 for corporation. Requirements for kra waiver application. In this video, i answer the question about if (and when) the irs will waive penalties and interest and i show you exactly how to request the irs to remove. List the type(s) of tax for which this request applies along with the amount of penalty and the tax period(s) covered. Interest is a compounded daily interest with a if you have to file late or if you have already filed late in a previous years, you can request to have both your interest and penalties waived.

If an air force installation uses the sample letter as a guide for. However, getting your penalties waived is not a guarantee. List the type(s) of tax for which this request applies along with the amount of penalty and the tax period(s) covered. How do i ask hmrc to waive any fines for filing late? Fill penalty waiver request letter sample, download blank or editable online.

Then provide all of the requested information.

The 10% failure to pay penalty for trust taxes, such as sales tax and withholding tax, is not subject to the good compliance record reasons if the taxpayer. The penalties are equal to five percent of the balance owed plus and an additional percent for each month you are late. How to write a letter to waive fees sample letter of waiving. I am requesting that you waive the penalty fee and interest assessed on the above referenced account for the month of.,2013.the payment here was sent only one day late because of end of the year mailing issues.the payment was received only request for waiver of late subcharge of tax. How to waive penalty for missed filing date and secretary of state charging penalty of $250 for corporation. Waiver of penalty letter example. Then provide all of the requested information. How do i ask hmrc to waive any fines for filing late? Penalty abatement does not remove the penalty only the penalty dollars at the time of request. How to request a waiver of interest and penalties on insurance premium taxes, circumstances beyond control, disasters, civil disturbances, service disruptions, serious illness or accident, delay in process, interest, penalties. Waiver of late tax payment / filing penalty. Request for transcript of tax return. Nc5500 request to waive penalties web 412 north carolina department of revenue part 1.

Start filling in the fillable pdf in 2 seconds. How to write a letter to waive fees sample letter of waiving. Alternatives to requesting waver of interest and penalties. Interest charges will still required to be paid even though penalties are waived or reduced. How to you know if you have a kra penalty.

Sdl and/or uif interest can't be waived.

Ssn of spouse (if request to waive pet licensing late fee penalties communities of clive, urbandale and west des moines part 1. To others that want the sample letter, i am a little behind in creating the form so that people can get the letter automatically. In this video, i answer the question about if (and when) the irs will waive penalties and interest and i show you exactly how to request the irs to remove. I am requesting that you waive the penalty fee and interest assessed on the above referenced account for the month of.,2013.the payment here was sent only one day late because of end of the year mailing issues.the payment was received only request for waiver of late subcharge of tax. Section 11 of the skills development levies act and section 12 of the unemployment insurance fund act doesn't offer any. You may also send a letter to us at the address below explaining the situation and the reason you believe you should not be. Fees and penalties may be waived for any registration year when a transferee (including a dealer) issued by dmv that matches the year for which the transferee is requesting a waiver of fees and waiver of penalties on vehicles sold at wholesale auction (cvc §9561.5). I am writing to request that you waive the penalty of {amount} on account number {number}. I recognize that a mistake was made by me and would rectify the problem. Then provide all of the requested information. However, getting your penalties waived is not a guarantee. I would like to work out a payment plan with edd but i would like edd to waive the penalty amount. How to request a waiver of interest and penalties on insurance premium taxes, circumstances beyond control, disasters, civil disturbances, service disruptions, serious illness or accident, delay in process, interest, penalties.

Komentar

Posting Komentar